|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

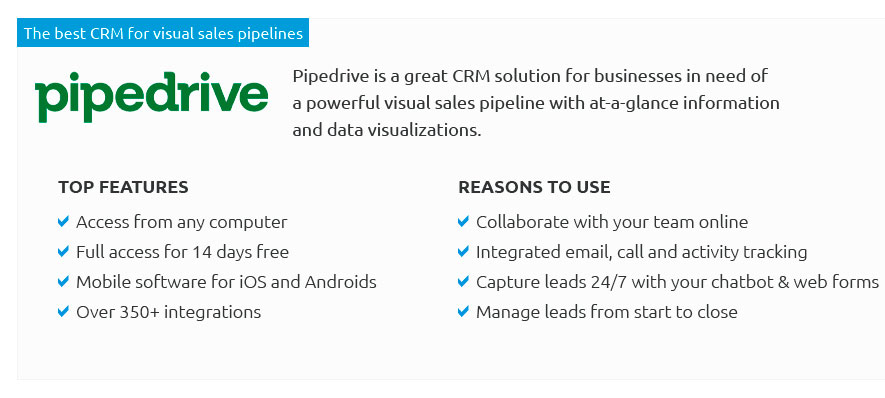

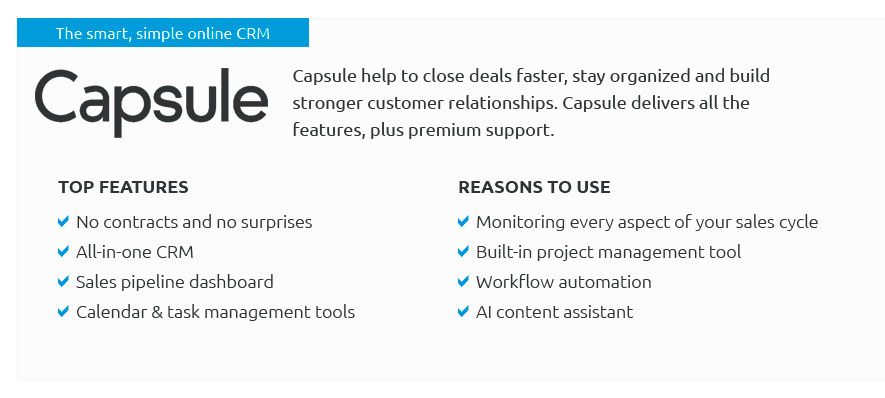

w73aek2u78 Understanding Loan CRM Software for Enhanced Customer ManagementLoan CRM software is a specialized tool designed to streamline and enhance the process of managing customer relationships within the loan industry. As financial services become more customer-centric, leveraging such software can significantly improve interactions and efficiency. Key Features of Loan CRM SoftwareCustomer Data ManagementA primary feature of loan CRM software is the ability to manage and organize customer data effectively. This includes storing and accessing personal details, loan histories, and communication records, all in one centralized location. Automated CommunicationAutomation capabilities facilitate timely communications with clients, such as payment reminders and loan status updates. This helps maintain customer engagement and satisfaction. Reporting and AnalyticsDetailed reporting and analytics features allow for in-depth insights into customer behavior and loan performance. These insights help in making data-driven decisions and improving business strategies. Benefits of Using Loan CRM SoftwareAdopting loan CRM software offers numerous benefits, including improved efficiency, better customer service, and enhanced compliance with regulatory requirements.

For a broader perspective on CRM tools, you might explore a list of the top 10 CRM tools available in the market. Choosing the Right Loan CRM SoftwareSelecting the right software involves assessing your business needs, budget constraints, and the specific features required to meet your operational goals. Assess Your NeedsDetermine which features are critical for your business operations. Consider factors such as integration capabilities, scalability, and user-friendliness. Budget ConsiderationsWhile some solutions might offer advanced features, it's crucial to balance costs against the benefits they provide. Ensure the software fits within your financial constraints. For a detailed comparison of CRM options, visit comparing CRMs to make an informed choice. FAQWhat is loan CRM software?Loan CRM software is a tool designed to help financial institutions manage their customer relationships more effectively by automating communication, storing data, and providing analytics. How does loan CRM software improve customer service?By centralizing customer data and automating routine tasks, loan CRM software allows staff to provide more personalized and timely service, improving overall customer satisfaction. Can loan CRM software help with regulatory compliance?Yes, many loan CRM solutions include features specifically designed to ensure that processes comply with industry regulations, reducing the risk of legal issues. https://www.goodvibesquad.com/blog/best-mortgage-crms-for-loan-officers/

A mortgage CRM is a software platform designed to help loan officers manage, track, and nurture relationships with all their leads and clients. https://setshape.com/mortgage

From bulk and video messaging to emojis and GIFs, our tools help you engage clients and close more loans effortlessly. Get a Demo. Shape Software CRM Mortgage ... https://ijungo.com/

The most comprehensive Salesforce solution for mortgage and real estate professionals. Close more deals with seamless integrations, ready-to-send marketing.

|